The practice of medicine entails treating patients and saving lives. And yet, due to the vast complexities of the United States Healthcare System, physicians, nurses, therapists, and other healthcare providers are inundated with administrative burdens that eat away at their valuable time and create unbridled levels of stress. Among the most burdensome processes is the means by which providers get paid for services rendered. Because of the intricate specificities mandates by insurance companies and federal payers, the management of creating and submitting claims, appealing rejections and denials, and capturing patient financial responsibilities owed to providers has resulted in the rise of the revenue cycle management industry, whose foundation is medical billing and medical coding. In order for any healthcare organization to run smoothly, great diligence, professionalism, and expertise are required so to maximize the collections owed to the organization and simultaneously master the medical accounts receivables process. Herein lies the Revenue Cycle Management: administrative functions directed toward claims processing, payment reconciliation and posting, and revenue collection. Without a robust Revenue Cycle Management process in place, private practice physicians, for example, will inevitably have to close their doors, lose their autonomy, and seek opportunities elsewhere, as they will not be fiscally positioned to sustainably keep their practices open to treat patients, due to poor revenue collections and delayed cash flow. For the reason, it is absolutely critical to have certified experts managing a provider’s revenue cycle process.

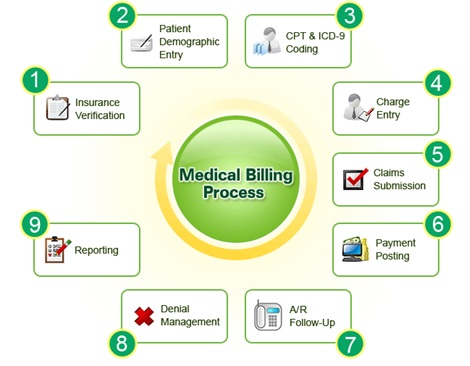

The Revenue Cycle:

1. The RCM process begins with a patient scheduling an appointment for a medical services. RCM experts will do the insurance benefits and eligibility verification is prior to the patient visit, and the front-end check-in team confirms upon the patient’s arrival.

2. The patient registration process entails obtaining a medical history and preliminary clinical data as well as inputting insurance coverage/changes and demographic information.

3. Now the patient may see the provider and undergo the actual medical services and/or procedures. In some instances, a prior authorization may be mandated by the patient’s insurance company to approve the service or procedure being rendered (so that the provider can get paid after services).

4. Once the medical service or procedure is delivered, the provider will document the patient encounter. All-the-while, a professional medical coder will assess the encounter clinical notes and translate them into the appropriate ICD-10 and CPT codes necessary to accurately reflect every aspect of what the provider has rendered in the visit.

5. Once the coding is complete, a medical biller will review and format the claim as per payer requirements and submit it to a Clearinghouse, which approves the claim’s general formatting and transmits it to the payer.

6. The claims gets assessed by the payer, and if all is accurate, the payer will transmit a reimbursement for the claim based on the patient insurance and the provider-payer negotiated contract. Herein, a medical biller will post the claim payment to indicate that the balance owed has been paid on a particular patient’s account.

7. A medical billing AR specialist will continue to follow-up on any outstanding balances from payers and patients in order to maximize collections as quickly as possible so to minimize cash flow issues.

8. Inaccurate patient demographics, miscoding, improper formatting, and/or missing clinical notes are some examples of why claim denials occur. These denials must be followed-up on as soon as possible in order to prevent cash flow issues for the organization.

9. All medical billing and coding components of the Revenue Cycle must be accurately depicted in easy-to-read, user-friendly reports so that physicians and managers can lead their organizations effectively and efficiently with objective claims data.

If the Revenue Cycle is not operating with excellence, the entire organization is in financial jeopardy. Reimbursements should be hassle-free, patients should be satisfied with customer service for billing inquiries, A/R management should minimize payment delays, rapid claim submission and same-day denial turnaround time should mitigate any cash flow issues, and accurate coding should optimize payments while minimizing audit risks.

Are you a provider with Revenue Cycle issues? Worried about if enough cash came in on time to make payroll and pay bills? Noticed dwindling reimbursements? Worried you may have to sell the practice, lose autonomy, and become employed by a hospital or other groups?

If so, you will want to look to outsource your Revenue Cycle Management processes to a data-driven, highly-reputed, well-established, transparent and reasonably-priced RCM firm that excels in what they do, with automated systems to perfect claims management and physician testimonials to support their claim of excellence.

Feel free to Contact Us if you’d like for us to provide you with a free analysis of your Revenue Cycle.